What Are Budgeting Tools?

Budgeting tools refer to systems—whether manual or digital—that enable individuals and organizations to manage their financial resources effectively. These tools track where money comes from, categorize spending, and help ensure expenses stay within budget.

Budgeting tools can range from as basic as a pen-and-paper ledger to as sophisticated as apps integrated with artificial intelligence and machine learning. The purpose of all these tools is the same: to promote smart money management by providing insights, reminders, and controls that ensure financial discipline.

Table of Contents

Why Are Budgeting Tools Important?

In the world of fast-paced transactions, online subscriptions, credit purchases, and fluctuating markets, it is easy to lose track of money. Here is why budgeting tools are more important than ever:

1. Promote Financial Awareness

They help you understand where your money comes from and where it goes. This awareness is the first step toward taking control of your financial future.

2. Encourage Savings and Investments

By analyzing your spending patterns, these tools highlight opportunities for savings. Some advanced tools also suggest personalized investment plans based on your goals.

3. Prevent Overspending

Most apps come with alerts that notify users when they are nearing their budget limit or exceeding their spending limit.

4. Simplify Tax Preparation

Many tools allow users to categorize expenses and generate detailed reports, which can be especially helpful during tax season.

5. Support Long-Term Planning

Budgeting tools help individuals set and achieve long-term financial goals, such as homeownership, education, retirement, or business expansion.

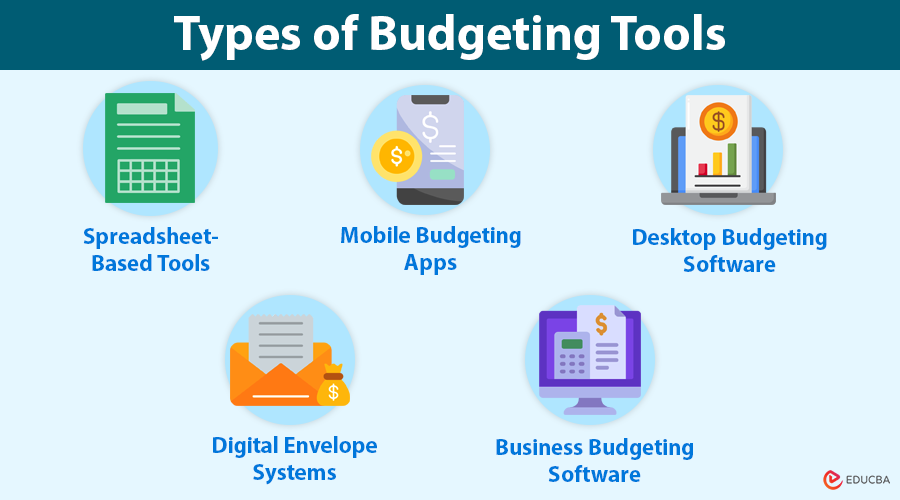

Types of Budgeting Tools

There are several types of budgeting tools, each suited to different needs and preferences. Let us take a deeper look:

1. Spreadsheet-Based Tools

Individuals or small businesses often use these to maintain full control over the budgeting process.

- Examples: Google Sheets, Microsoft Excel

- Features: Budget templates, formulas, customizable categories

- Advantages:

- No cost involved

- High flexibility

- Offline and online access

- Disadvantages:

- Manual data entry is time-consuming

- No automatic transaction updates

- Requires some knowledge of spreadsheet functions

Best For: Beginners, students, and small-scale planners.

2. Mobile Budgeting Apps

Mobile apps are popular due to their accessibility and user-friendly interfaces. Most apps sync with your bank accounts to track expenses in real time.

- Examples:

- Mint: Offers budget tracking, credit monitoring, and personalized financial advice.

- YNAB (You Need a Budget): Uses a zero-based budgeting method to assign every dollar to a job.

- PocketGuard: Shows how much money you can safely spend after bills and savings.

- Advantages:

- Real-time updates

- Visual dashboards and charts

- Sync across multiple devices

- Disadvantages:

- Some features may require a subscription

- Privacy and data sharing concerns

Best For: Individuals, freelancers, and families with multiple income and expense streams.

3. Desktop Budgeting Software

These programs are best suited for individuals or businesses that require robust tools with advanced features, such as forecasting, investment tracking, and report generation.

- Examples: Quicken, Moneydance, GnuCash

- Advantages:

- Feature-rich solutions

- Detailed reporting and tracking

- Great for offline use

- Disadvantages:

- Costly

- Less convenient than mobile apps

- Requires installation and updates

Best For: Small business owners, accountants, and advanced users.

4. Digital Envelope Systems

Inspired by the traditional envelope budgeting method, this approach divides your monthly income into specific categories (envelopes), such as rent, groceries, transportation, etc.

- Examples: Goodbudget, Mvelopes

- Advantages:

- Easy to follow

- Encourages disciplined spending

- Disadvantages:

- Not ideal for complex budgets

- May not accommodate unexpected expenses

Best For: Beginners, couples managing joint finances.

5. Business Budgeting Software

Organizations use business budgeting tools to monitor and plan their finances professionally.

- Examples: QuickBooks, Xero, PlanGuru

- Features:

- Multi-user access

- Payroll integration

- Financial forecasting

- Profit and loss statements

- Advantages:

- Streamlined operations

- Automated reconciliation

- Accurate financial projections

- Disadvantages:

- Expensive

- Learning curve for new users

Best For: Startups, SMEs, and financial managers.

Key Features of Budgeting Tools

When selecting a budgeting tool, consider whether it offers the following features:

| Feature | Description |

| Account Syncing | Connects to your bank and imports transactions |

| Automated Categorization | Organizes spending into relevant categories like food, travel, and bills |

| Goal Setting | Helps track progress toward savings or debt repayment goals |

| Custom Budgets | Allows creation of budgets for special events or projects |

| Reporting & Dashboards | Visual insights through charts, pie graphs, and bar diagrams |

| Multi-Currency Support | Useful for international users or travelers |

| Cloud Sync | Enables access across devices |

| Security Features | Includes encryption and authentication for data safety |

Benefits of Using Budgeting Tools

1. Greater Financial Discipline

Sticking to a budget becomes easier when you can visualize spending and receive reminders.

2. Faster Debt Repayment

Tracking payments and allocating funds strategically allows faster clearance of loans or credit card balances.

3. Improved Savings

Budgeting tools suggest monthly savings targets and adjust them based on your income.

4. Easier Collaboration

Some tools enable multiple users (e.g., spouses or co-founders) to manage finances jointly in real time.

5. Better Business Decisions

With tools that offer cash flow projections, profit analysis, and expense breakdowns, business owners can make informed strategic choices.

How to Choose the Right Budgeting Tool?

Use the following checklist to evaluate the right budgeting tool:

- Purpose: Personal use, family, or business?

- Budget: Do you want free software, or are you willing to pay for premium features?

- Ease of Use: Is the interface beginner-friendly?

- Automation Level: Do you want bank syncing and auto-categorization?

- Device Compatibility: Do you prefer mobile access, desktop use, or both?

- Customer Support: Does it offer help tutorials, chat, or email support?

- Security Standards: Ensure end-to-end encryption and secure data storage.

Free vs Paid Budgeting Tools

| Category | Free Tools | Paid Tools |

| Cost | ₹0 (ad-supported) | ₹300 – ₹1,000/month or one-time fee |

| Features | Basic expense tracking | Advanced analytics, AI predictions |

| User Type | Casual users, students | Businesses, finance professionals |

| Examples | Mint, Google Sheets | YNAB, QuickBooks, PlanGuru |

| Support | Limited | Dedicated or premium support |

| Ads | May include ads | Usually ad-free |

Real-Life Use Cases

- Working professionals use apps like YNAB to assign every rupee a job and prioritize emergency funds.

- Parents manage household expenses using Google Sheets, allowing them to plan groceries, tuition, and utility bills.

- Startups and small businesses utilize QuickBooks to manage payroll, create financial statements, and track quarterly performance.

- Travel enthusiasts utilize budgeting apps to allocate funds for flights, accommodations, food, and local transportation ahead of their trips.

Final Thoughts

Budgeting tools are no longer optional—they are essential for navigating the financial landscape. From helping young professionals manage their monthly spending to enabling entrepreneurs to plan their business finances, these tools foster accountability, reduce stress, and enhance financial success.

As you explore different options, remember that the best budgeting tool is the one that suits your goals, habits, and lifestyle. Whether it is free or paid, basic or advanced, the right tool can change how you manage your money.

Frequently Asked Questions (FAQs)

Q1. Can budgeting tools help manage irregular income?

Answer: Yes, many budgeting tools are designed to accommodate irregular income sources such as freelance work, commissions, or gig-based earnings. Tools like YNAB allow you to assign every bit of income to a specific job, making it easier to manage fluctuating cash flow.

Q2. Are budgeting tools suitable for tracking shared expenses with roommates or partners?

Answer: Absolutely. Several tools offer multi-user support and shared budgeting features. Apps like Splitwise or Goodbudget allow you to track shared expenses, assign payments, and avoid confusion in group financial arrangements.

Q3. How secure are budgeting tools that connect to my bank accounts?

Answer: Most reputable budgeting tools use bank-grade encryption, multi-factor authentication (MFA), and read-only access to ensure the safety of your data. Always choose tools with strong privacy policies and verified security certifications.

Q4. Do any budgeting tools offer investment tracking?

Answer: Yes, tools like Quicken, Personal Capital, and Moneydance offer investment tracking features. They allow you to monitor portfolios, assess asset performance, and plan for long-term wealth accumulation.

Recommended Articles

We hope this guide on Budgeting Tools has been insightful. For more expert-led finance resources, check out these articles:

.wrap {

padding: 0rem 0;

}

}

.breadcrumb {

/*margin-bottom: 20px!important;*/

padding-top: 140px;

padding-left: 120px;

}

.breadcrumb.rbc3 {

padding-top: 135px!important;

}

@media (min-width: 768px){

.wrap {

width: 98%;

max-width: 100%;

padding: 0;

}

footer.site-footer .wrap {

width: 90%;

max-width: 1280px;

}

.content {

padding: 2rem!important;

border-radius:10px;

}

.content-sidebar-wrap .content {

padding: 0rem !important;

}

}

.has-fixed-header .site-header.fixed .mega-search.mega-search-open input[type=text] {

border: 1px solid #ccc!important;

}

.has-fixed-header .site-header.fixed li.mega-menu-item-137987 a.mega-menu-link, .has-fixed-header .site-header.fixed li.mega-menu-item-138113 a.mega-menu-link, .has-fixed-header .site-header.fixed li.mega-menu-item-370765 a.mega-menu-link, .has-fixed-header .site-header.fixed li.mega-menu-item-138221 a.mega-menu-link, .has-fixed-header .site-header.fixed li.mega-menu-item-138228 a.mega-menu-link, .has-fixed-header .site-header.fixed li.mega-menu-item-138242 a.mega-menu-link, .has-fixed-header .site-header.fixed li.mega-menu-item-138292 a.mega-menu-link, .has-fixed-header .site-header.fixed li.mega-menu-item-138378 a.mega-menu-link, .has-fixed-header .site-header.fixed li.mega-menu-item-138454 a.mega-menu-link, .button.accent {

background-image: linear-gradient(to top,#e93f33,#ea4b32,#eb5632,#ec6032,#ec6a33)!important;

}

h1, h2, h3, h4, h5, h6, .entry-content h2{

font-family: ‘Montserrat’, sans-serif!important;

color: #10656d!important;

}

.entry-content li, .entry-content ol, .entry-content p, .entry-content table, .entry-content ul {

color:#273239!important;

font-family: -apple-system,system-ui,BlinkMacSystemFont,’Segoe UI’,Roboto,Oxygen-Sans,Ubuntu,Cantarell,’Helvetica Neue’,Arial,sans-serif;!important;

font-size:19px !important;

line-height:1.9 !important;

}

.entry-content h2 {

border-bottom: 2px solid #10656d !important;

}

.breadcrumb a {

color: #273239 !important;

font-family: -apple-system,system-ui,BlinkMacSystemFont,”Segoe UI”,Roboto,Oxygen-Sans,Ubuntu,Cantarell,”Helvetica Neue”,Arial,sans-serif !important;

text-decoration: underline;

font-weight: 500;

font-size:1.4rem !important;

}

body, p, ul.rounded-list {

font-family: -apple-system,system-ui,BlinkMacSystemFont,”Segoe UI”,Roboto,Oxygen-Sans,Ubuntu,Cantarell,”Helvetica Neue”,Arial,sans-serif!important;

}

.sname, #ifclass, ul.rounded-list li.sub .subli li:hover a {

color: #0693a0 !important;

}

ul.rounded-list li.sub .subli li a {

color: #273239 !important;

font-family: -apple-system,system-ui,BlinkMacSystemFont,”Segoe UI”,Roboto,Oxygen-Sans,Ubuntu,Cantarell,”Helvetica Neue”,Arial,sans-serif!important;

}

#fix-bar::-webkit-scrollbar-thumb{

background: #B6B6B6 !important;

-webkit-box-shadow: inset 0 0 6px rgb(0 0 0 / 30%);

background-color: #F5F5F5;

border-radius: 10px 10px 0px 0px!important;

}

ul.rounded-list li.sub, .subcat-name {

font-family: ‘Montserrat’, sans-serif!important;

}

.single-title a {

font-size: 1.4rem !important;

font-weight: 500;

text-decoration: none !important;

color: #273239 !important;

}

.single-title span {

font-size: 14px !important;

}

.entry-content a {

color: #0693a0 !important;

font-weight: 700;

text-decoration: none !important;

}

h3:after {

background: #0693a0 !important;

}

#fix-bar::-webkit-scrollbar {

width: 10px !important;

height: 5px;

}

ul.rounded-list li.sub .subli li a {font-weight: 500 !important;}

#ifclass{display:none!important}

.rounded-list ul.subli li a:before {content:none!important}

.rounded-list a{padding:.1em .4em .1em 2em!important}

ul.rounded-list ul li {line-height: 2.4!important;}

/*.entry-content h4, .entry-content h5 {

color: #0693a0 !important;

}*/

.entry-content h5 {font-size:20px}

.entry-content pre {background-color: #fff !important;padding: 0 !important;border-left: none !important;border: none !important;}

.subcat-name {color:#0693a0!important;font-weight:700;}

.contentinner h4 {font-family:-apple-system,system-ui,BlinkMacSystemFont,”Segoe UI”,Roboto,Oxygen-Sans,Ubuntu,Cantarell,”Helvetica Neue”,Arial,sans-serif!important}

table td,th{border-left:2px solid #d2d2d2;vertical-align:text-top}#list2::-webkit-scrollbar,#sticky::-webkit-scrollbar,#ullist::-webkit-scrollbar{width:5px}#list2::-webkit-scrollbar-track,#ullist::-webkit-scrollbar-track{background:#f1f1f1}#list2::-webkit-scrollbar-thumb,#ullist::-webkit-scrollbar-thumb{background:#f1f1f1}#list2::-webkit-scrollbar-thumb:hover,#ullist::-webkit-scrollbar-thumb:hover{background:#888}#list2:hover::-webkit-scrollbar-thumb,#ullist:hover::-webkit-scrollbar-thumb{background:#888}@media (max-device-width:480px) and (min-device-width:320px){.entry-content code{width:auto;overflow:scroll}.entry-content pre{width:auto;overflow:scroll}.entry-content .wp-video{width:auto!important}}@media (max-device-width:767px) and (min-device-width:481px){.entry-content code{width:470px;overflow:scroll}}@media (max-device-width:890px) and (min-device-width:768px){.entry-content code{width:750px;overflow:scroll}}@media only screen and (min-device-width:891px){.entry-content code{width:auto}}.breadcrumb a{color:#e93f33;text-decoration:underline;font-family:’Nunito Sans’,-apple-system,blinkmacsystemfont,’Segoe UI’,roboto,helvetica,arial,sans-serif}.entry-content a{color:#e93f33;border-bottom:1px solid;text-decoration:none}.entry-content a:focus,.entry-content a:hover{border-bottom:transparent}@media (min-width:768px){h1{font-size:3em}h2{font-size:2em}h3{font-size:1.8em}h4{font-size:1.5em}h5{font-size:1.4em}h6{font-size:1.3em}.content-sidebar-wrap{width: 98%;

max-width: 1200px;

display: flex;

flex-wrap: wrap;}}h2{font-size:2em}h3{font-size:1.8em}h4{font-size:1.5em}h5{font-size:1.4em}h6{font-size:1.3em}body>div{font-size:18px;font-size:1.6rem}b,h1,h2,h3,h4,h5,h6,strong{font-family:’Nunito Sans’,-apple-system,blinkmacsystemfont,’Segoe UI’,roboto,helvetica,arial,sans-serif;font-weight:700!important}@media (min-width:768px){body>div{font-size:1.8rem}.content {

padding: 0 2rem!important;

}}.entry-content ol,.entry-content ul{margin-bottom:1.618em;margin-left:4rem}.entry-content li,.entry-content ol,.entry-content p,.entry-content table,.entry-content ul{color:#4d5968;line-height:2;font-family:’Nunito Sans’,-apple-system,blinkmacsystemfont,’Segoe UI’,roboto,helvetica,arial,sans-serif}@media (min-width:896px){.content-sidebar-wrap{padding:3rem 0!important}.content{

width: -webkit-calc(57.5% – 1rem);

width: calc(57.5% – 1rem);

}.sidebar-primary {

width: 23%;

}}.leftshift{left:70%!important}.content-sidebar-wrap-bg{background: #0a635fab;}.inline-pp-banner-bg {background: #faffbd82;}.img-op{opacity: 0.5;}@media only screen and (min-width: 1024px) {

.sidebar-content-sidebar .sidebar-secondary {

order: 0;

width: 19.5%;

}

.sidebar-content-sidebar .content {

order: 1;

}

.sidebar-content-sidebar .sidebar-primary {

order: 2;

}

}

.breadcrumb{margin-bottom:0}

.fa-chevron-right:before{

color: #000000;

content: url(https://cdn.educba.com/academy/wp-content/uploads/2022/12/b_arrow.svg);

width: 12px;

height: 18px;

padding-right: 0.9rem;

font-size: 0rem;

font-weight: 700;

vertical-align: middle;}

.swp_social_panel a {color:white!important}.othr-cour a{color:#4a4a4a!important;border-bottom:none}.othr-cour a:hover{border-bottom:1px solid!important}.box-div .fa-book:before{content:”f14e”}.box-div .fa-book{background-image:linear-gradient(to top,#0ba360 0,#3cba92 100%);padding:15px;border-radius:5px;color:#f0f8ff;font-size:50px}.box-div .fa-flash:before,.fa-bolt:before{content:”f1fa”}.box-div .box-btn{width:max-content;cursor:pointer;transition:.2s;padding:10px 30px;line-height:1.33;border-radius:4px;color:#fff;background:#ff8c00;border:thin solid #ff8c00;margin-bottom:0;font-weight:700;text-align:center;vertical-align:middle;font-size:15px;display:block;letter-spacing:1px;background-image:linear-gradient(to top,#e93f33,#ea4b32,#eb5632,#ec6032,#ec6a33)}.box-div{margin:10px 0 25px;padding:24px;width:100%}.box-div .course-title{font-weight:700;font-size:1.3em;letter-spacing:1px;display:block;min-height:110px}.box-div .fa-star{font-size:15px;color:#f5af12;margin-right:4px}.box-div .price-box{text-align:-webkit-center}@media (min-device-width :320px) and (max-device-width :520px){.box-div .banr-image{display:none}.box-div .price-box{text-align:-webkit-left;margin:15px 0}}@media (min-device-width :320px) and (max-device-width :767px){.sale-bf{position:absolute;width:80px;margin-top:-5.4em;right:0}}.box-div .othr-cour{border-radius:4px;border:1px solid #4a4a4a;margin-right:12px;padding:5px 10px;font-size:14px;font-weight:400;display:inline-block;margin-bottom:5px;cursor:pointer;line-height:1.4}.box-div .rel-cour{font-size:16px;padding-bottom:5px}@media (min-device-width :768px){.centertext{text-align:center}.sale-bf{position:absolute;width:120px;margin-top:-6.1em;right:2.5em}}.blg-price{font-size:1.5em;font-weight:700;}.blg-str-price strike{font-size:1.2em;color:grey;font-weight:700;}.box-div hr{margin:0 0 .5em;padding:.5em 0 0}.box-div .course-title{line-height:25px}.box-div .banr-image{text-align:center;margin-top:20px}.box-div .bundle_link{text-decoration:none;color:#000!important;border:0}.box-div .bullets{font-weight:400;font-size:.9em}#banner_1_rb .three-sixths{margin-top:15px}#banner_1_rb .five-sixths{width:100%;margin:0}#banner_1_rb .course-price{font-size:1em}#banner_1_rb:hover{-webkit-box-shadow:0 9px 5px -6px rgba(0,0,0,.75);-moz-box-shadow:0 9px 5px -6px rgba(0,0,0,.75);box-shadow:0 9px 5px -6px rgba(0,0,0,.75)}#banner_1_rb{background-image:url(‘https://cdn.educba.com/academy/wp-content/uploads/2022/11/Project-Management.jpg’);padding:30px 14px;background-size:cover;background-position:top center;position:relative;width:100%;font-family:Montserrat,sans-serif!important}.bf_badge{position:absolute;right:-2px;top:-12px;width:90px;}@media only screen and (max-width:896px) and (min-width:320px){.three-sixths{width:100%!important}#banner_1_rb{width:100%!important}.uk-grid-margin{padding-left:0!important}.bf_badge{position:absolute;right:-1px;top:-9px!important;width:70px!important;}}

]]>

In today’s fast-paced world, managing your finances can often feel overwhelming, leaving many feeling uncertain about their economic stability. By exploring practical strategies and insights in the article Taking Control of Your Financial Future, you can empower yourself to make informed decisions that pave the way for a more secure financial path.